A Provider Bill Designed to Gouge

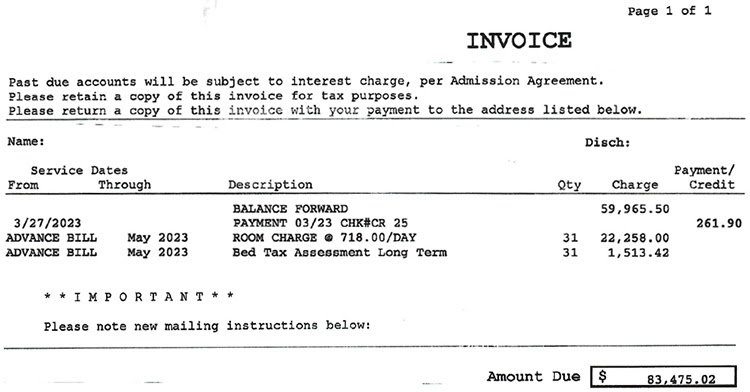

Today’s video is a case study in questionable billing practices and a warning to anyone who has the responsibility to review provider bills, especially for large, ongoing amounts like nursing home charges, to do so thoroughly. The video is prompted by receipt of a nursing home statement showing $83,475.02 due when $87.30 was actually due. A copy of the bill with identifying information deleted is below.

Last year I became financially responsible for a relative who was admitted to a nursing home. The home is a nonprofit organization with a religious affiliation and lofty mission statement. No comment. The nursing home has outsourced the billing and receivables functions.

Anyway, my relative is on original Medicare, a Plan G supplement and an excellent long-term care policy that covered 100% of his daily rate until January. In January, the nursing home instituted a rate increase which resulted in a shortfall of $2.91 per day as the new rate exceeded the long-term care policy’s daily maximum benefit.

I have been alarmed at several of the nursing home’s billing practices.

First, their bill includes charges for a month in advance of the billing period. This is an expensive nursing home in a high-cost area of the country. Charges are per day so vary by month but are roughly $22,000 or $23,000/month while private pay. I am not aware of other types of providers who “advance bill.” The nursing home’s billing staff know the long-term care company won’t pay a claim on an “advance bill.” That seems reasonable. After all, if a patient is discharged, transferred or dies, on any day other than the last of the month, then the nursing home would have been overpaid and the family or estate due a refund.

Second, the monthly statements are sent out after the long-term care claim has been filed which the facility’s outsourced billing company manages, but before the claim has been paid. This also results in an inflated bill. The long-term care company typically processes claims within two weeks of receipt which is likely to either meet or exceed industry practice.

Third, in August there were 12 days where the facility was paid in full twice, first by the combination of Medicare and the supplement and, second, by the long-term care policy. Medicare became primary at that time so the nursing home shouldn’t have filed a claim with the long-term care company for those days. I waited for many months to see if the nursing home would identify the duplicate payment. If the nursing home billers recognized the overpayment, they did nothing to correct the situation. Subsequent statements didn’t identify the amount as a credit balance.

For many months, I’d ignored these statements for the most part although occasionally I would send an email as follows: “I am in receipt of your most recent statement which I believe you know is not correct.” However, I had to act on receipt of the most recent statement which threatened assessed interest on balances due.

I reiterated what I have written here and acknowledged that I hadn’t sent payment for the $87.30 owed for April ($2.91 x 30 days) but asked, can we agree there is a zero-balance due as of March 31, 2023? Remarkably, I received a prompt response the same morning acknowledging that there was no balance due as of March 31, 2023. I had also attached to this email the Medicare Summary Notice for the 12 days in August 2022, the explanation of benefits statement for the same 12 days from UnitedHealthcare, the supplemental carrier, and the long-term care claim statement covering those 12 days. The response from the outsourced nursing home biller to my query about the overpayment was also quick. They acknowledged they owed a refund to the long-term care company.

Of course, my task isn’t over. With a refund situation, one wants to see that the nursing home returns or credits the overpayment and that the long-term care company adjusts payments made. Otherwise, my relative’s long-term care policy lifetime maximum would be short that amount.

Healthcare is frustrating but one must be practical. At times we recommend paying small bills even when we believe they are incorrect because it is too time-consuming to dispute them. However, in a situation where bills are significant, always be vigilant! You and your family can be victims of questionable billing practices from even the most reputable providers.

Thanks for reading and please watch the video.