California Blue Shield Works to Disrupt PBMs (Pharmacy Benefit Managers)

I doubt that everyone knows what Pharmacy Benefit Managers (PBMs) are, but these organizations are key to determining what we pay for drugs. They have played a critical role in healthcare for years now. They are the organizations that purchase drugs from manufacturers on behalf of insurance companies. The large PBMs whose names you may recognize are owned by large health insurance companies, as noted below.

The controversy regarding Pharmacy Benefit Managers, whose purchasing role includes negotiating discounts and rebates with drug manufacturers, involves accusations that they keep too large a percentage of those savings for themselves. These savings are meant to be passed on to patients. Blue Shield of California, which has a membership of 4.8 million, has announced a radical but complex move to ultimately reduce drug costs for its members beginning in 2025.

At its simplest, and it’s not simple, there are distinct layers of businesses involved in getting drugs from the manufacturer to the patient and, ultimately, paying for the drugs.

- Companies that manufacture drugs, Pfizer, Merck, Johnson & Johnson, Eli Lilly, etc.,

- Companies that negotiate drug prices between manufacturers and insurers, so-called Pharmacy Benefit Managers like Caremark (CVS), Optum (UnitedHealthcare), Express Scripts (CIGNA), etc.,

- Companies that distribute drugs to patients, such as local pharmacies, CVS, Walgreens, mail order pharmacies, Mark Cuban’s Cost Plus Drugs, Amazon Pharmacy, etc.,

- Companies that pay drug claims on behalf of insurers to those that dispense drugs.

There are others. Activities can be outsourced by the above companies, there are regulatory agencies involved, of course, and companies like GoodRx and its competitors. Companies like GoodRx were originally intended to serve those who did not have drug coverage but have come to be a resource for those with drug coverage due to some of the perverse situations with pricing which occur today.

For today’s discussion we’ll focus on what California Blue Shield is attempting to accomplish and how extremely operationally challenging it will be.

California Blue Shield has used CVS Caremark as its PBM but recently announced a new direction for the organization. According to an article published by the American Hospital Association in August, California Blue Shield’s unhappiness with CVS Caremark stems from situations concerning drugs like Zytiga, a generic prostate cancer drug manufactured by Johnson and Johnson, which had cost about $3,000/month. According to the article, California Blue Shield was apparently able to negotiate with an alternative supplier for a cost of $160/month but it took five months for CVS to offer the cheaper alternative.

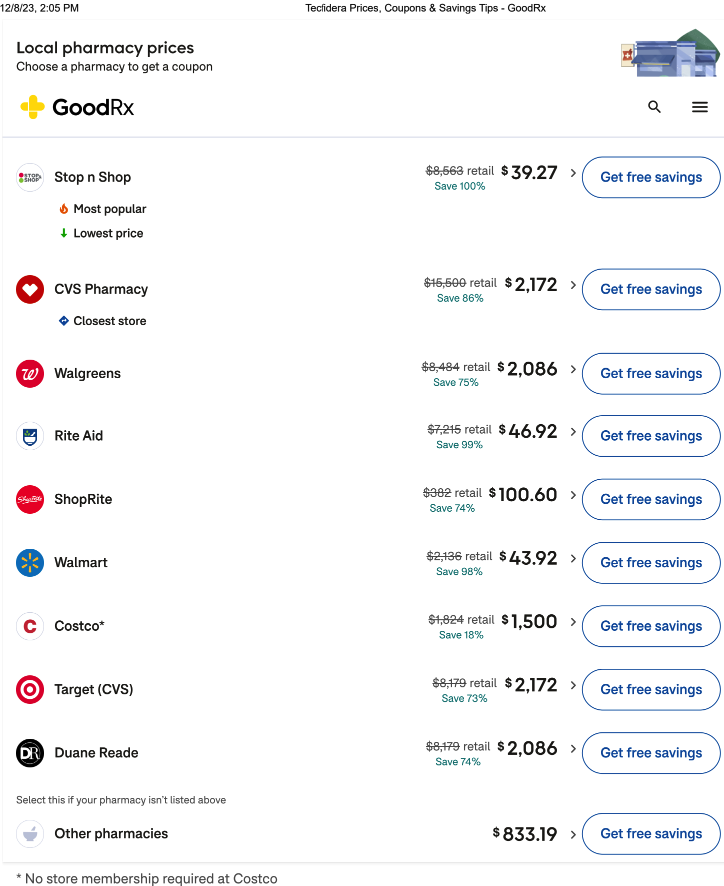

Another example in an article published by healthcaredive.com in October focused on the generic version of a multiple sclerosis drug, Tecfidera, which is reportedly available through Cost Plus for a monthly supply of $39.50 compared to an average monthly supply of $6,617 at other pharmacies. We questioned these figures so entered the drug into GoodRx and the results are below. As you can see, the retail price of the drug ranges from $332 at ShopRite to $15,500 at CVS and the GoodRx price ranges from $39.27, very similar to the Cost Plus price, to $2,172 at CVS and Target. Nothing justifies these predatory prices.

Although California Blue Shield will maintain a relationship with CVS Caremark, it will be greatly altered by the introduction of two other so-called “disrupters” we have written about before, Amazon Pharmacy and Cost Plus.

According to reports, beginning in 2025, California Blue Shield’s members will be served by the following organizations:

- Amazon will provide free delivery of prescription medications.

- Cost Plus will monitor drug prices and work to keep them low at retail pharmacies.

- Prime Therapeutics will negotiate drug prices with drug manufacturers.

- CVS will continue to provide specialty pharmacy services.

Another organization, Abarca, will pay prescription drug claims.

Many are skeptical of California Blue Shield’s claim to save as much as $500 million per year in drug costs. This will be a fascinating story to follow and there are already others that have surfaced. A cover story headline in the Wall Street Journal on December 5 reads CVS Revamps the Way it Sets Drug Prices with a goal of “bringing greater clarity and accountability to drug pricing.”

As we have said many times, dealing with drug issues is one of the biggest headaches of our healthcare system. We’re rooting for California Blue Shield and for all other entities working to make matters fairer for patients.

Thanks for reading and enjoy the holidays. We’ll be reposting educational material for the rest of December. Check back in January for new material. Thanks.