Despicable Medical Billing Practices

It is an unfortunate fact that in the United States consumers must be on the defensive when it comes to medical billing. For many years news stories have highlighted the financial risks and disparities associated with being out-of-network or being uninsured as well as surprise medical bills. We have consistently emphasized in our videos and blog material that remaining in-network with your plan provides the most financial protection. After all, in-network relationships are governed by a legal contract executed by both the provider and your insurance company.

Unfortunately, in spite of the obvious protections, unsavory practices are too commonplace with in-network providers. This is why we have cautioned against placing too much trust in the accuracy of medical bills. In-network providers should not overcharge you, yet we see that they often do. How does this happen?

One unfortunate practice involves generating a medical bill before a claim is even submitted. This should not happen. Only a copayment should be collected before a claim is processed. Even when the patient is in the deductible period and has financial responsibility for 100% of the approved claim amount, the claim should be processed before a bill is generated by the in-network provider. Once the claim is processed, the provider and the patient both receive an explanation of benefits (EOB) statement indicating the amount that can be billed to the patient. If the provider believes the claim was processed incorrectly or underpaid, the provider should challenge the insurer prior to billing the patient.

I provide an example in the video of a bill for a COVID test I received last year. I could see immediately that the bill showed no adjustment or payment from my insurer, CIGNA. I knew I had met my deductible so there should have been some payment made. I can’t tell exactly what happened with this claim, but remarkably it went back and forth between the Hospital and CIGNA for eight months. The test was done in August of 2020 but not paid until April of 2021. I received a bill in early September of 2020 for $128.08. The charges were shown on the EOB as $225.00 and CIGNA ultimately paid $74. In the end, I had no financial responsibility because by the time the claim was processed, I had met my out-of-pocket maximum when the insurer pays at 100%.

Another example provided in the video is my husband’s dentist asking for payment at the time of visit. This is a similar issue. The claim hasn’t been submitted but the staff represent that they know what the member responsibility is and ask for my husband’s credit card to charge that amount. They have been wrong on several occasions and always in the direction of overcharging. Fortunately, they issue a refund promptly in those instances after I call and inform them of the discrepancy between what they charged and the amount shown as “member responsibility” on the explanation of benefits statement. And what if I had not called requesting the refund? I rather doubt the overpayment would have been refunded.

Yet another example provided in the video is of my chiropractor’s office. They charged a specialty copayment amount at the time of service of $35.00. I could see on mycigna.com, my portal, that the member responsibility for chiropractic services was 10% coinsurance which was $7.08. Of course, this points to other problems. It’s not sensible to structure benefits with a low coinsurance amount applied to a relatively minor claim which results in generating a bill for such a small amount. Nevertheless, I had no obligation to pay more than $7.08 for the visit.

Finally, the most egregious example of despicable medical billing practices described in the video is the bill I received last December from a local pathology group. My physician ordered some blood work during the summer of 2020 for which the Pathology group was ultimately paid $2089. I could see on my mycigna.com portal that CIGNA was requesting additional information to process the claim. This can be an annoying insurance company tactic at times but the request seemed quite legitimate. However, instead of providing the additional information as requested, the Pathology Group billers simply resubmitted the same claim three times to CIGNA.

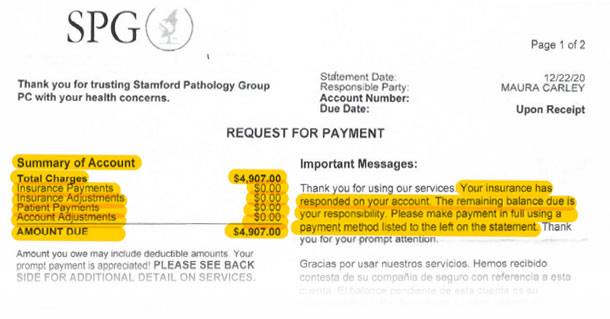

In December of 2020, they sent me a bill for $4907, shown below, which indicated that the total amount was my responsibility. In fact, I had no financial responsibility because I am fortunate to have excellent coverage and had met the out-of-pocket maximum. I left the Pathology Group Billing Department a voice mail message indicating they knew and I knew I didn’t owe that amount. But it is easier and potentially more lucrative to bill the patient (and at almost two and a half times the negotiated rate they were ultimately paid) rather than supply the insurer with requested documentation. In other industries such practices would be considered fraudulent and illegal but there is more tolerance of such bad behavior in healthcare.

We urge you to learn more about coverage so you can identify these indefensible practices and only pay amounts you actually owe. It is always important to act timely because the most ruthless billing staff will send an account to collection which can affect your credit rating.

Thanks for reviewing this information. Please watch the video and tell others to watch and learn too!