Qualifying Events

We have done several videos on specific qualifying events like moving or death of a spouse but today we wanted to address qualifying events in a more general way. Qualifying events allow an individual to be added to coverage outside the normal (typically annual) enrollment cycle. Many think of qualifying events as only associated with losing coverage but, please remember, they also apply to events like marriage or adding a baby to your plan which provide an opportunity to add an individual to coverage.

Two very important issues apply to qualifying events:

- There is always a timeframe within which one must act, usually 60 days, to add someone to coverage or, when someone is losing coverage, to apply for new coverage or COBRA, as applicable;

- Unlike during the open enrollment cycle, documentation of the event which is relevant to the situation is required like a birth certificate, marriage certificate, COBRA notice, a utility bill showing a new address, etc.

And for purposes of this discussion, let’s leave out Medicare which has its own enrollment rules which are very distinct from non-Medicare rules. Although Medicare eligibility might be through a spouse, actual Medicare entitlement applies to individuals and different life events, disability, turning 65 or losing active group coverage after age 65.

Another issue regarding qualifying events worth emphasizing is that certain qualifying events frequently referred to are NOT qualifying events depending on the situation. Hence, someone turning 26 who has coverage through active employment doesn’t experience a qualifying event by turning 26. Similarly, divorce is only a qualifying event if you are the dependent on a soon-to-be-former spouse’s plan. And in the individual market, moving is not a qualifying event if you move within your zip code or local area but it is if you move to another state or a region within your state where your current Plan is not sold.

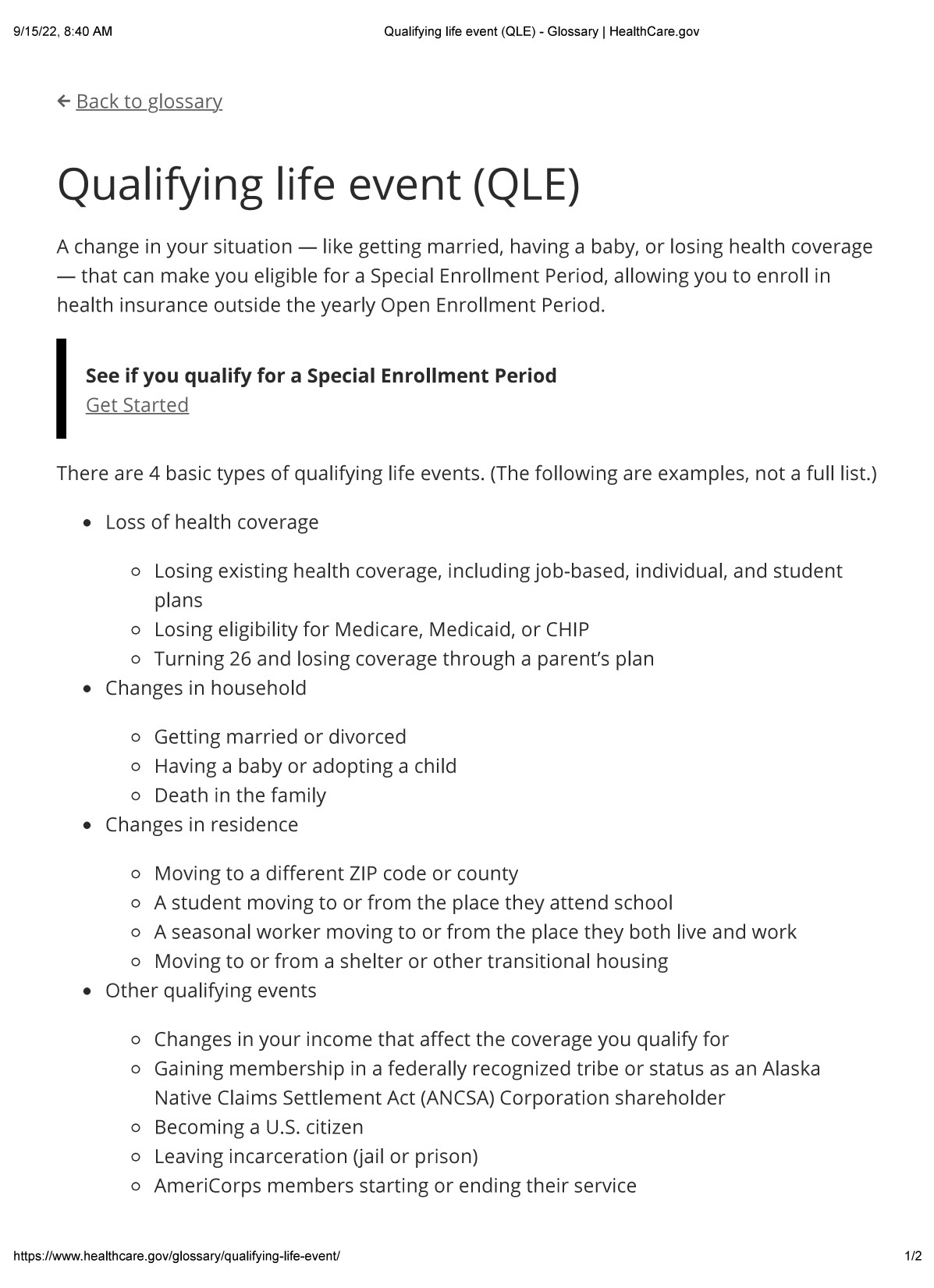

Healthcare.gov has a one-page description of qualifying events on its website which we have included as an attachment at the end of this copy. Please review this information if any of this remains confusing. Please note, however, that this information refers to a change in zip code as a qualifying event and, as noted above, that is not always the case.

Healthcare coverage in the United States is complicated. Our advice to everyone is to encourage family members (at a certain age of course) to understand how they are covered and how they might lose that coverage so they are prepared to act, if necessary. This is so important. We regularly speak to people losing their jobs and coverage who have no idea that each dependent in the family has his/her own COBRA coverage rights and that in almost all situations covered by federal COBRA, dependents have a 36-month COBRA extension period rather than an 18-month COBRA extension period.

The U.S. healthcare system is fragmented so make sure you and yours know what to do when experiencing a qualifying event.

Please watch the video and encourage others to do so.